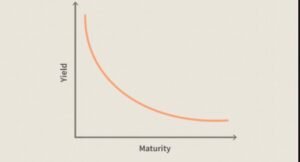

The time value of money (TVM) is the idea that cash you presently have today is worth more than an equivalent amount in the distant future because of its potential earning power. This principal of economics holds that any amount invested today can earn more interest over time than an equivalent amount in cash. This principle underlies all investment opportunities and has long been used to manage funds, allocate capital gains and ensure that funds are available when required.

TVM is also used to determine whether or not to invest in a given security. To calculate this, divide the current market value of the security by the expected future value, which is what investors will pay to buy the security in five years. In order to arrive at the value of the security, divide the net present value (NV) times the prospective returns. This will give you the net present value of your investment.

There are a number of ways you could use this formula to ensure that you receive the maximum amount of your investment in the shortest time possible. It is important to remember that TVM only applies to cash. It does not work for stock, bonds, mutual funds or other investments where the valuation of the asset is not known at the moment of purchase. If you do not have enough cash today to cover the cost of your investment, you cannot invest it today and earn the amount you need tomorrow. For people who are employed, calculating TVM can be slightly easier because they are able to subtract their income tax from their net pay.

There are two main ways of how you can calculate the time value of money: numerically and using a financial calculator. Many people prefer to calculate the worth of money electronically because they are easier to understand and more accurate. The calculator is a good way to learn how much your money’s value is today. To get a visual idea of what your money’s worth is, you can calculate how much it would be worth under various investment scenarios by using a financial calculator.

You should consider your goals when learning how to calculate the time value of money. You may want to use this method to help determine whether an investment is worthwhile or not. For example, if you are planning on making a substantial amount of investment income, then you will need to learn how to invest for the long term and not just for the short term. The formula is also helpful in determining if you are willing to pay high interest rates for a loan or mortgage. A low interest rate today will mean that you will pay more interest in the long run if you do not choose the right loan options in the long run.

When you learn how to calculate the time value of money, you will have a better understanding of how different investments work. This can help you make better decisions with your money so that you can grow your portfolio over the long and short term. Using the present value of your portfolio will help you determine whether an investment is a worthy investment or not depending on current interest rates and other factors. It can also help you determine the correct way to diversify your portfolio so that you have some of your investments in order to ride out a bad economy or unexpected disaster such as a natural disaster.

Calculating the time value of money will give you an idea of the amount of interest you will earn today if you lend dollars today. Knowing how much you will earn in the future will help you decide whether or not you should borrow money in the future or if you can wait out the economic downturn. Knowing how much future value of your bond, stock, or mutual fund investment will earn you is important. Knowing whether the present price is more than it will be in the long run will help you determine whether it is wise to hold onto a stock or mutual fund investment that has a long term prospective.

In order to use this particular mathematical form of the equation, you must have some previous knowledge of how the formula works. The Time value of Money Formula was created by Alfred Nobel Prize winnervaneenth 1890s. The formula is a very simple equation that you can learn to use even if you are a novice in the world of finance. It takes into account the amount of your income, the amount of your expenditure, and how much is left over after paying for all your expenses. The time value of money reflects the amount of interest you are likely to earn over the term of your loan.