Many times, I have been asked the difference between micro and macro economics. Microeconomics is the micro aspects of a macroeconomic model. These are the kind of things that drive the overall macro picture. So what are these? The five most important include supply and demand, capital, investment, output, and technology. In other words, everything that affects the macro-economy is a part of macroeconomics.

Microeconomics, as opposed to macro, refers to a smaller scale version of the larger macro economic model. It usually deals with business cycles, spending patterns, investment decisions, unemployment, and consumer demand. Micro has much less fundamental influence on the macro picture than does macro, although it can still have significant effects. For instance, changes in the business cycle can affect micro aspects of demand, causing a change in output, and employment.

So, what is the difference between micro and macro in economics? In most cases, there is no big difference at all. Microeconomics deals mainly with local economies, where the focus is more on the micro elements of the economic problem.

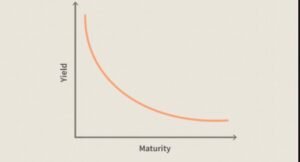

macro is the larger view of the economy. It typically makes use of models (such as the National Income Forecast model or the Phillips curve) in order to forecast the long-term effects of national economic policies. While it can provide valuable long-term guidance, it does not reflect all the smaller details of the macro-economic model. For instance, it doesn’t take into account the impact of interest rates, which have a large impact on short-term interest rates. It also doesn’t factor in the feedback loop of the business cycle, which is how most models of macroeconomic policymaking make adjustments for the business cycle.

However, these are not the only effects of macro models that they don’t capture. Many macro models also don’t take into account the effects of global economics, such as currency exchange rates or stock market fluctuations. For example, a commonly used model of macroeconomic policy makes no mention of world events, like wars or terrorist attacks. Although the effects of these events on economies can be large, the effects of world politics on the economy are not factored into most macro models.

On the other hand, micro-economic policies to make sure that these effects are factored into the models that they create. As an example, the optimal rate of interest is calculated according to the demands and supply conditions in the economy. The adjustments made in the long run are adjusted in response to current circumstances, such as an increase in inflation. This flexibility within the model allows it to capture the very small changes that occur on a micro level.

A lot of research has gone into the design of macroeconomic models. However, many economists believe that there are significant limitations with the existing macroeconomic models. Mainly, these limitations relate to the inability to address important issues such as unemployment. Furthermore, macro models are unable to explain behavior of the national level. For example, unemployment rates and inflation affect the entire economy but are controlled by macro economic models at the national level.

Micro-economic models are gaining more popularity with every passing day. With their simplex nature, they make it easy to calculate economic trends and their effects on the economy. They are also widely used by forecasters to determine the behavior of short-term interest rates. Some experts believe that micro trends will eventually replace macroeconomic thinking in the near future. In the meantime, however, micro-economic models continue to remain a popular tool with economists all over the world.